Freelance web developer based in New York

Expert development services by NYC-based freelancer for your website needs.

Proudly collaborated with some of the biggest brands

I’m John Smith. I’m passionate about crafting exceptional websites. With a blend of design skills and coding expertise, I create unique online experiences that captivate users.

Looking for a top-notch web developer to revamp your hotel’s website? Look no further than John Smith. With years of experience and a keen eye for design, John can take your site to the next level, helping you attract more visitors and boost your bookings.

Services

Front End

Our web developer is proficient in designing beautiful and intuitive interfaces that enhance user experience, making our hotel’s website a pleasure to navigate.

- Donec aenean duis vel id mattis nunc

- Suscipit integer amet adipiscing adipiscing

- Velit habitasse cursus velit

Back End

Our web developer can handle complex server-side processes including database management, ensuring seamless functionality of the website.

- Donec aenean duis vel id mattis nunc

- Suscipit integer amet adipiscing adipiscing

- Velit habitasse cursus velit

Full Stack

Our full-stack web developer is a one-stop-shop for all web development needs – from creating visually stunning front-ends to handling complex back-end processes, making our hotel website run smoothly and efficiently.

- Donec aenean duis vel id mattis nunc

- Suscipit integer amet adipiscing adipiscing

- Velit habitasse cursus velit

Featured Work

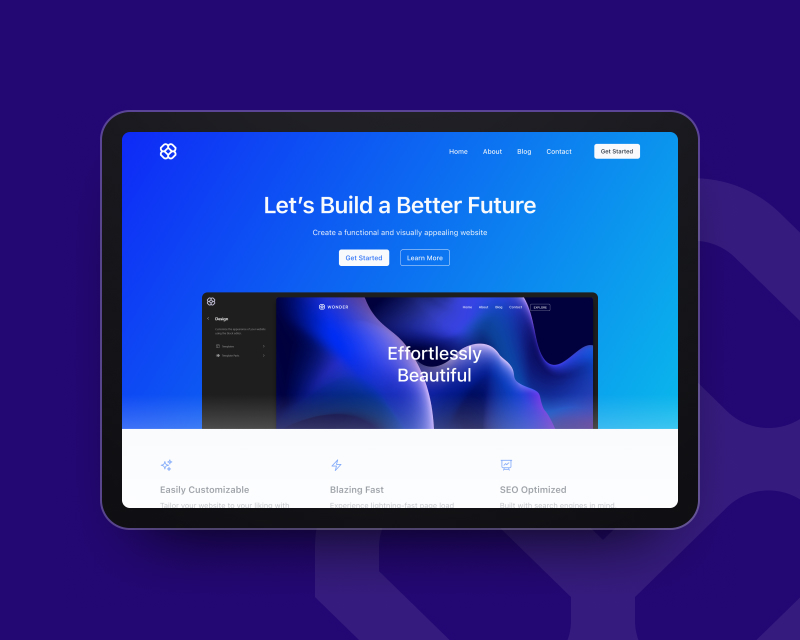

Nientex Website Redesign

Revamp your online presence with a modern and user-friendly Nientex website redesign that showcases your hotel's luxury amenities and increases bookings.

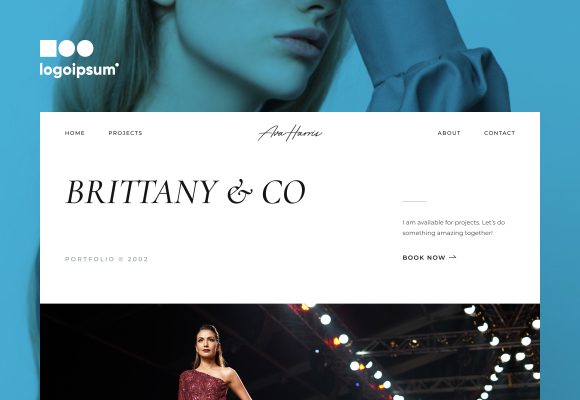

Brittany & Co Front Store

NeuroApp Landing Page

Ozone Esport Platform

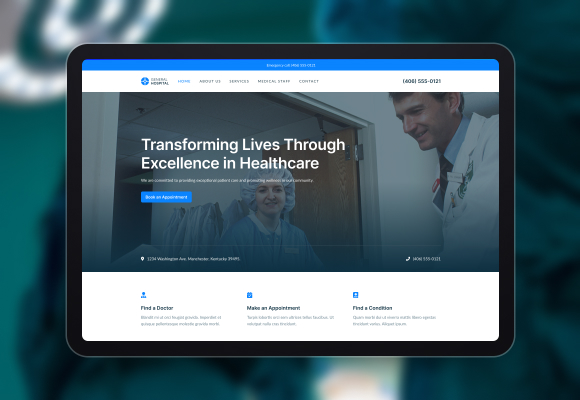

NY Hospital CRM

Years of experience

Successful projects

Happy clients

Individual awards