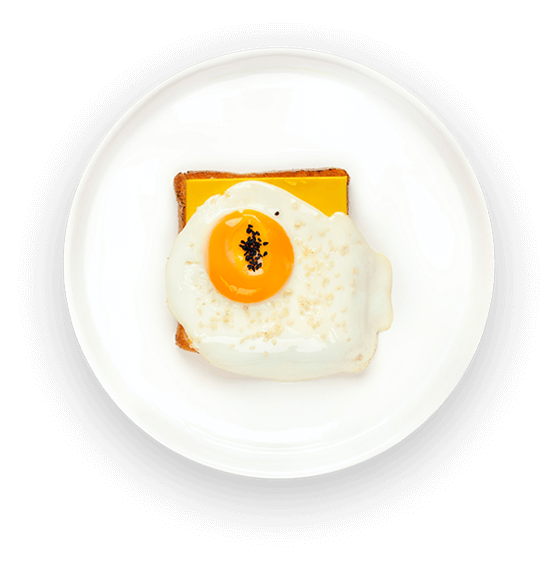

crack, cook, enjoy

Eggstraordinary flavors for any appetite

About Us

We are a New York's premier eggs specialty restaurant founded by Jack Bloom. We have a dedicated menu showcasing the versatility and deliciousness of eggs in all their forms, from classic omelettes and egg sandwiches to more unique creations like our egg and avocado toast or our smoked salmon and scrambled eggs

Donec ac rutrum libero, vitae gravida leo. Quisque in nulla purus. Nulla scelerisque neque turpis, ac sagittis lorem volutpat a. Sed sed neque massa. Mauris blandit accumsan semper. Vestibulum consectetur congue nunc. Proin blandit mauris nibh, ut ornare turpis gravida vel. Vivamus ac mi enim. Sed tincidunt quam ac risus egestas, ut ornare ex hendrerit

Menu

Taste the versatility and deliciousness of eggs in all their forms

Location

Where you can find us

Contact

Phone

(555) 555-1234

Address

13 Fifth Avenue, New York, NY 101660

Opening hours

Monday-Friday

9:00 AM - 10:00 PM

Saturday

9:00 AM - 18:00 PM

Sunday

Closed

Reservations

Book your table online now