Original Sunglasses

Original Sunglasses

Fusce scelerisque tellus eget nisl vulputate, et eleifend sapien tempor nulla tristique.

Text Here

A few words about us

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Add Your Heading

Be different in your own way!

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

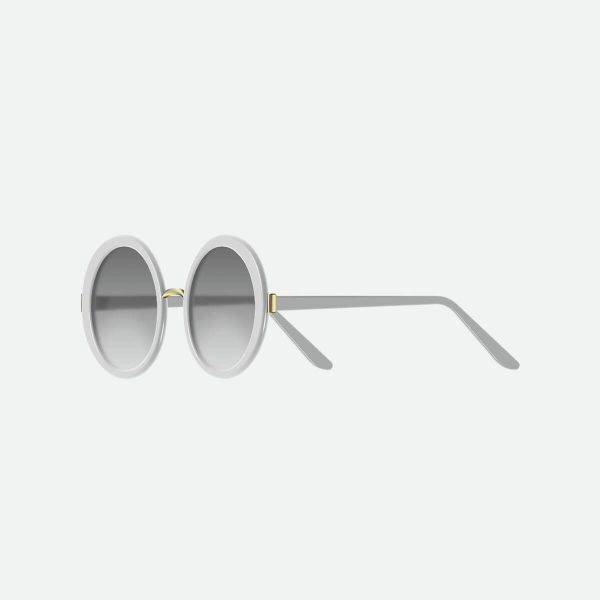

Product Name 9

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

$135.00Add to cart

Clients’ reviews

Testimonials

Heading Text Here

How to take care of your eyewear

Curabitur neque ex, facilisis id venenatis in, tincidunt at augue. Etiam lobortis commodo tristique. Aliquam convallis pulvinar facilisis.

Popular Products

Trending now

-

Rated 0 out of 5

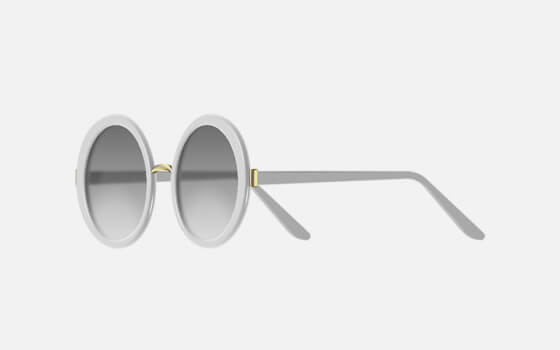

Product Name 1

$175.00Original price was: $175.00.$150.00Current price is: $150.00.

Big discounts

Integer euismod blandit nunc sit amet sollicitudin. Fusce quis orci viverra, cursus justo lipsum dolor.

Free Shipping

Integer euismod blandit nunc sit amet sollicitudin. Fusce quis orci viverra, cursus justo lipsum dolor.

Secure payments

Integer euismod blandit nunc sit amet sollicitudin. Fusce quis orci viverra, cursus justo lipsum dolor.