The final action of your FHA buying techniques was closure. That’s where you can easily sign all files, spend your own closing costs, and also have the latest keys to your new house. Basic yet not, you will need to learn more about the new FHA system by itself and you will how it benefits you due to the fact a borrower.

The latest FHA System

The Federal Housing Administration, commonly referred to as FHA, has been rewarding their aim of support home-based mortgages because the Congress developed the program from inside the 1934. While the their first, FHA features insured more than 47 mil properties, therefore it is the greatest mortgage insurance carrier all over the world.

FHA apps make it more comfortable for buyers-eg first-big date homebuyers-to invest in property of the reducing the certification procedure having recognition and by enabling the newest borrower and come up with a down payment out of as low as step 3.5% of the value of the loan. Loan providers try wanting to issue FHA-recognized mortgage loans as funds is actually guaranteed in full by government government in case there is a debtor standard.

The way the FHA System Support Consumers

One of the prominent indicates the FHA system assists consumers was by reducing minimal credit rating needed seriously to getting recognized to have financing. The newest Department out-of Housing and you may Metropolitan Advancement (HUD), and that tools FHA applications, has actually the absolute minimum rating requirement of 580 getting borrowers seeking take advantage of the step 3.5% down-commission option. Most lenders giving a traditional (otherwise non-FHA) home loan require visitors to have a minimum rating out of everywhere ranging from 620 to 650 so you’re able to be considered.

Another advantage of FHA ‘s the ability to have the whole down payment talented for you regarding someone else, for as long as both the present together with giver satisfy FHA requirements. With old-fashioned mortgage loans, loan providers normally lay a threshold into level of provide money you could potentially put for the this new down-payment-in the event that something special is enjoy after all.

Finally, FHA fund is assumable. Consequently you could transfer the new regards to your FHA financing to another debtor in the event you have to sell your residence down the road. The customer will have to meet with the exact same FHA requirements to help you be approved towards the financing, nonetheless is suppose the fresh conditions and terms which were place in position during the time the first FHA mortgage are awarded. This can be such as for example helpful in the event that home loan rates has grown due to the fact modern pick. With the rest of your terms, the new debtor can suppose the reduced rate of interest when selecting the house. The web perception is the fact that house is more straightforward to promote on new borrower.

Whom Qualifies having FHA Financing?

Because FHA program is appropriately named broadening accessibility homeownership, individuals need to however meet a number of certificates and you will standards. Listed here are just a few:

- The debtor have to be 18 years of age

- The home getting purchased should be the top residence of your borrower

- A credit history off between five-hundred and you may 579 is necessary having a great 10% down-payment

- A credit score greater than 580 needs to have good step three.5% downpayment

- Appraisals have to be conducted Greeley loans companies because of the FHA-acknowledged appraisers

- Mortgages must be given of the FHA-accepted lenders

- This new borrower need to have at least a couple of years off a position record

- The latest borrower have to have an obligations-to-income proportion that’s no higher than fifty%

Most other small print apply, without a doubt, also home owners and you can home loan insurance rates standards, however, while the for each and every debtor have an alternate group of things, for each recognition and closing is unique.

The fresh new FHA Closure Process

Before the closing techniques actually initiate-and you can before you even begin interested in a property-a skilled real estate attorney will be hired. A bona-fide home attorney will help show you from procedure, of offer in order to closure. After a contract are finalized, i don’t have much a legal professional will perform in case the words are bad toward customer. Such as for instance, when you create a deal, the a house attorneys is to keep the serious money in your stead, and when the offer goes crappy.

Once you have discover a property, generated an offer, and it is already been acknowledged, that is if genuine functions begins towards a home lawyer.

Earliest, our house must appraise towards purchase price (or higher). On appraisal out of the way, their closure attorneys will then carry out a subject search.

Marketable label is required, since it assures that the possessions you might be seeking to purchase is not encumbered having any a fantastic municipal liens, judgements, otherwise taxes. FHA direction need all of the identity points or issues as eliminated up before settlement, therefore, the this new mortgage is actually first lien updates.

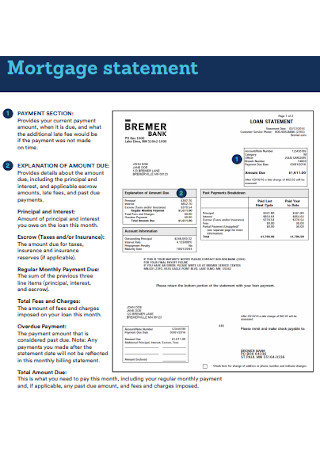

Before closing, you’re getting a closing costs revelation, which the lawyer normally comment to you. This will become your entire settlement costs while the final share you will have to give to you to the closure. Closing costs normally are financial charges, possessions income tax escrows (if any), home insurance, escrow charge, prepaid notice (if any) identity insurance rates, questionnaire, credit history, or any other financing-associated will cost you. As each purchase is unique, there is certainly more charges beyond those mentioned right here.

When the time comes to possess closure, payment tend to usually occur in certainly about three locations: the latest label insurance carrier, the fresh lender’s place of work, otherwise the home attorney’s office.

What to expect On Closing

The newest closing itself usually takes any where from one or two circumstances, with respect to the preparedness of visitors and you will seller additionally the shed closes that need to be tied. Typically, brand new closing broker will be present, also the real estate professionals and you will a home attorneys to own the consumer and you will supplier.

- Reviewing and you will signing most of the mortgage data files

What direction to go Now

Should you decide to buy a property having fun with a great FHA loan otherwise to shop for a house straight from FHA, then you is find the help of an experienced home lawyer with the intention that your rights is actually secure.

Having a bona-fide property attorneys inside it right from the start of one’s to acquire techniques can save a lot of time and cash into the the long run. The good thing is utilizing a real house attorney to close your own exchange cannot cost more than playing with a subject team for these types of services.

Get in touch with Bruce R. Jacobs to determine just how he is able to help you. You could arrived at your from the mobile on (954) 961-1993 otherwise by e-mail by this website to plan a consultation and you can discover more and more your liberties. The guy also offers a free first appointment.